About Best Bankruptcy Attorney Tulsa

About Best Bankruptcy Attorney Tulsa

Blog Article

Which Type Of Bankruptcy Should You File - An Overview

Table of Contents10 Easy Facts About Tulsa Bankruptcy Lawyer DescribedThe Of Bankruptcy Lawyer TulsaThe smart Trick of Tulsa Ok Bankruptcy Attorney That Nobody is DiscussingEverything about Chapter 13 Bankruptcy Lawyer TulsaWhat Does Which Type Of Bankruptcy Should You File Do?The smart Trick of Bankruptcy Law Firm Tulsa Ok That Nobody is Discussing

People need to make use of Chapter 11 when their financial debts surpass Phase 13 financial obligation restrictions. bankruptcy lawyer Tulsa. Chapter 12 personal bankruptcy is made for farmers and anglers. Phase 12 settlement strategies can be more versatile in Chapter 13.The ways examination considers your typical month-to-month income for the 6 months preceding your filing date and compares it versus the median revenue for a comparable house in your state. If your earnings is listed below the state typical, you instantly pass and do not have to finish the whole type.

The financial debt limitations are provided in the graph above, and existing quantities can be confirmed on the U.S. Judiciaries Chapter 13 Personal bankruptcy Fundamentals website. Discover more concerning The Way Examination in Chapter 7 Insolvency and Financial Obligation Limits for Phase 13 Insolvency. If you are married, you can declare personal bankruptcy jointly with your partner or independently.

Filing insolvency can help a person by throwing out debt or making a plan to pay off financial obligations. A bankruptcy case usually begins when the borrower submits a petition with the bankruptcy court. There are different kinds of personal bankruptcies, which are generally referred to by their chapter in the United state Bankruptcy Code.

If you are encountering monetary difficulties in your individual life or in your business, opportunities are the principle of declaring bankruptcy has actually crossed your mind. If it has, it additionally makes good sense that you have a great deal of bankruptcy questions that require answers. Many individuals in fact can not respond to the question "what is bankruptcy" in anything other than general terms.

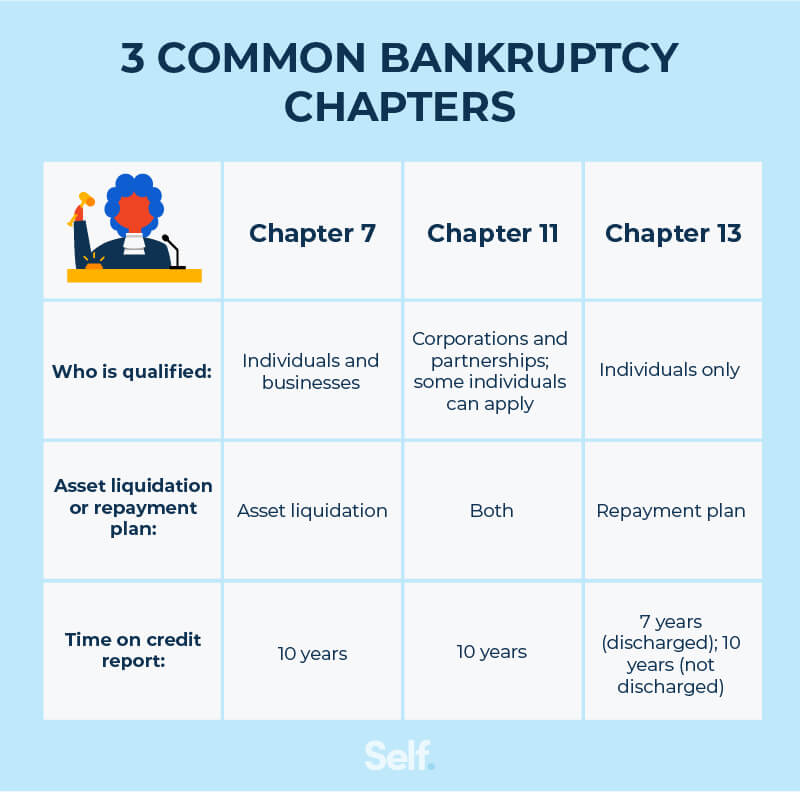

If you are encountering monetary difficulties in your individual life or in your business, opportunities are the principle of declaring bankruptcy has actually crossed your mind. If it has, it additionally makes good sense that you have a great deal of bankruptcy questions that require answers. Many individuals in fact can not respond to the question "what is bankruptcy" in anything other than general terms.Lots of people do not recognize that there are several types of bankruptcy, such as Phase 7, Phase 11 and Phase 13. Each has its benefits and challenges, so knowing which is the very best alternative for your existing scenario as well as your future recuperation can make all the difference in your life.

Fascination About Top-rated Bankruptcy Attorney Tulsa Ok

Chapter 7 is labelled the liquidation bankruptcy phase. In a chapter 7 insolvency you can get rid of, erase or release most sorts of debt. Instances of unsafe debt that can be wiped out are charge card and clinical expenses. All kinds of people and firms-- people, wedded couples, firms and partnerships can all submit a Phase 7 personal bankruptcy if eligible.

Several Phase 7 filers do not have much in the way of properties. They might be renters and own an reference older car, or no automobile at all. Some deal with parents, good friends, or brother or sisters. Others have houses that do not have much equity or remain in major need of repair.

The quantity paid and the period of the plan depends on the debtor's building, try this out median income and expenses. Creditors are not permitted to pursue or maintain any collection tasks or suits throughout the instance. If successful, these financial institutions will certainly be eliminated or released. A Phase 13 insolvency is extremely powerful since it supplies a system for borrowers to stop repossessions and constable sales and stop repossessions and utility shutoffs while capturing up on their protected financial obligation.

The smart Trick of Tulsa Bankruptcy Legal Services That Nobody is Discussing

A Phase 13 instance may be useful because the debtor is permitted to get captured up on mortgages or vehicle loan without the risk of foreclosure or foreclosure and is permitted to keep both excluded and nonexempt residential or commercial property. The borrower's strategy is a document describing to the personal bankruptcy court just how the borrower proposes to pay current costs while repaying all the old financial debt equilibriums.

It gives the debtor the chance to either offer the home or come to be caught up on home loan payments that have actually dropped behind. A person submitting a Chapter 13 can suggest a 60-month plan to cure or come to be existing on home mortgage repayments. For example, if you fell back on $60,000 worth of home mortgage settlements, you can suggest a plan of $1,000 a month for 60 months to bring those home mortgage payments existing.

It gives the debtor the chance to either offer the home or come to be caught up on home loan payments that have actually dropped behind. A person submitting a Chapter 13 can suggest a 60-month plan to cure or come to be existing on home mortgage repayments. For example, if you fell back on $60,000 worth of home mortgage settlements, you can suggest a plan of $1,000 a month for 60 months to bring those home mortgage payments existing.See This Report about Tulsa Bankruptcy Lawyer

Occasionally it is much better to stay clear of insolvency and work out with financial institutions out of court. New Jersey additionally has a different to insolvency for organizations called an Job for the Benefit of Creditors and our law firm will look at this alternative if it fits as a potential technique for your company.

We have produced a device that helps you select what phase your file is most likely to be filed under. Go here to utilize ScuraSmart and learn a feasible solution for your debt. Lots of individuals do not understand that there are a number of kinds of insolvency, such as Phase 7, Chapter 11 and Chapter 13.

Right here at Scura, Wigfield, Heyer, Stevens & Cammarota, LLP we manage all kinds of bankruptcy situations, so we have the ability to answer your personal bankruptcy questions and help you make the very best choice for your instance. Here is a short consider the debt alleviation choices readily available:.

8 Simple Techniques For Tulsa Bankruptcy Attorney

You can just submit for personal bankruptcy Prior to declaring for Chapter 7, at least one of these must be real: You have a great deal of financial obligation earnings and/or assets a financial institution might take. You have a lot of financial obligation close to the homestead exception quantity of in your home.

The homestead exception amount is the higher of (a) $125,000; or (b) the area typical list price of a single-family home in the coming before schedule year. is the quantity of cash you would keep after you sold your home and repaid the home loan and other liens. You can find the.

Report this page